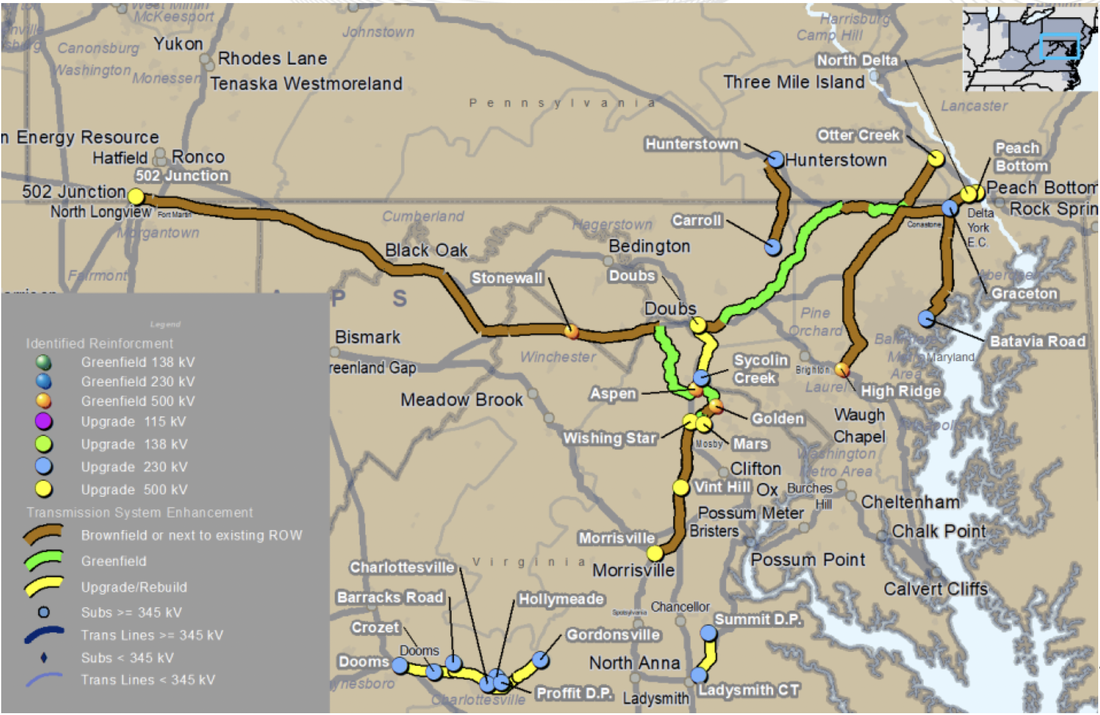

Last year, PJM solicited new transmission to solve future issues with the retirement of 11,000 MW of existing generation in the eastern part of its region due to state "clean energy" policies, and the addition of 7,500 MW of new data center load concentrated in Northern Virginia. In December, PJM selected and approved a huge portfolio of new transmission that looks like this.

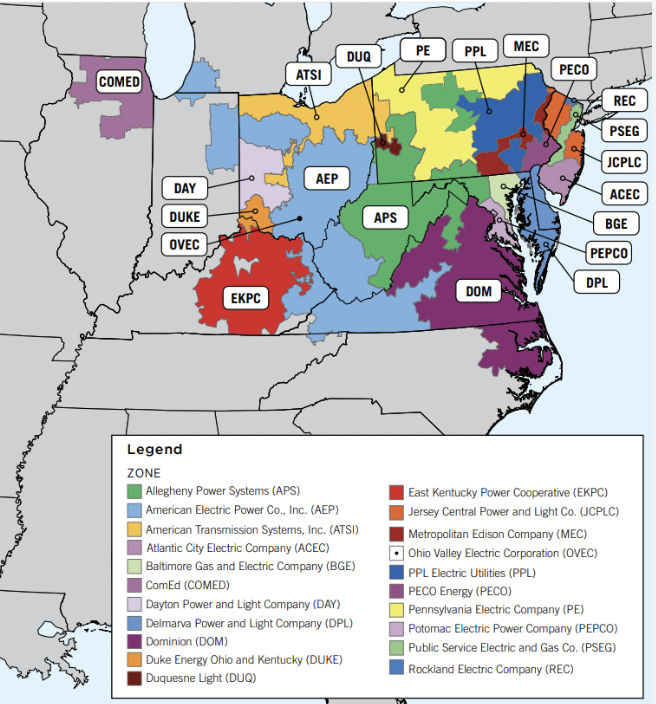

In January, PJM made a filing at the Federal Energy Regulatory Commission (FERC) to allocate the more than $5B cost of this new transmission according to its regional cost allocation formula for big, regional lines. Lines needed for regional reliability are allocated 50% to all load-serving utility zones across the region based on each zone's share of peak load for the preceding year. The zones with the largest load receive a bigger share of this 50% of the cost of the lines. The other 50% of the cost is allocated based on zones who will use the new lines. Here's a map of PJM's utility zones.

The old thinking also went that load increased incrementally around the entire region, with it being impossible to finger just one region for increased load, therefore everyone paid for regional increases in load. It was too hard to measure exactly where load was increasing over time, and no new user created an outsized increase in load that could be isolated and allocated to the cost causer. PJM cannot be changing its cost allocations constantly every time a new industrial plant asks for a connection, and these new users didn't cause a huge jump in power use when compared to the amount of power flowing across the region.

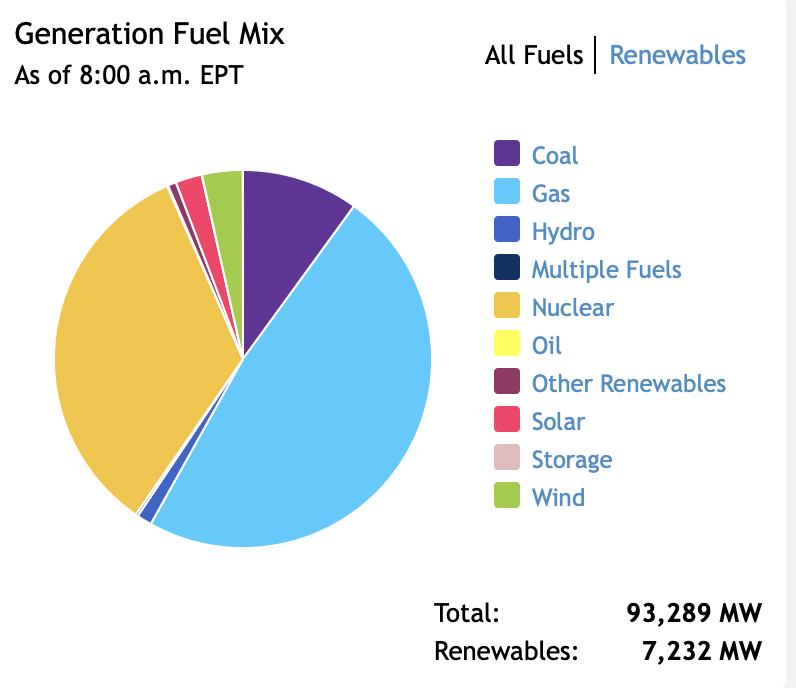

Toss that old thinking out the window! PJM's latest portfolio of projects CAN be tied to just two things... closing baseload generators in eastern PJM and increased data center load concentrated in a tiny spot on PJM's vast map. And what is causing that? State "clean energy" policies that require the closing of existing fossil fuel baseload generators and prohibit their replacement with similar generators that can produce hundreds of megawatts of electricity when needed. Replacement with renewables is a fairy tale. Renewables take too much land for the amount of power they produce, and the power they produce is not reliable. It takes many more megawatts of renewable power to equal one megawatt of fossil fuel power because renewables are such weak generators and they are intermittent and cannot be relied on to produce power when needed. If we rely on renewables to keep the lights on, we're only kidding ourselves. We cannot build enough renewables to take the place of all the fossil fuel generators in PJM that keep the lights on. Here's a graph showing the source of PJM's power this morning that is powering this computer, and everything that's making your Saturday happy.

Now that I've set the table (or maybe it was just a rant), let's get back to PJM's cost allocation filing. PJM makes numerous filings like this every year, and other regional grid operators do as well. It's usually routine... filing is made and FERC rubber stamps it. Sometimes a few entities will file objections, but they are rarely sustained. Once, about 20 years ago, numerous states objected to PJM's cost allocation for its Project Mountaineer transmission projects. These 500kV projects were for the purpose of increasing the use of coal-fired electricity in eastern PJM by 5,000 MW, and states in the other parts of PJM objected to paying for them. That case (Illinois Commerce Commission v. FERC) ended up at the 7th Circuit Court of Appeals... twice... before PJM adopted its current cost allocation methodology. The Court said that FERC had to demonstrate that the costs of those projects were allocated to the cost causers. Since then, things have settled down.

However, PJM's latest projects have lit another fire that is probably going to burn as bright as the last one. Something extraordinary is happening in PJM's cost allocation FERC docket. In addition to the comments filed by consumers, and the protest of the Maryland Office of People's Counsel that more of the cost should be allocated to Virginia than Maryland, last week the Virginia State Corporation Commission filed comments basically calling Maryland a hypocrite and stating that Maryland is equally to blame for these new transmission lines. I tend to agree... that both Maryland and Virginia are hypocrites! These are the two states causing all the "need" for new transmission lines that will be paid for by other states.

But it's not going to end there... a giant parade of entities have intervened in this case at FERC. Being an intervenor means you are a party to the case. Only parties have standing to request rehearing at FERC and eventually appeal the case in federal court.

Intervenors include:

- FirstEnergy (utility building some of the new lines)

- New Jersey Board of Public Utilities

- American Electric Power (utility building lines)

- Dominion (utility building lines)

- Exelon (parent company of utility building lines)

- Delaware Division of Public Advocate

- PPL (utility building lines)

- Calpine (generation company)

- Rockland Electric (utility in PJM assigned costs)

- Duquesne Light (utility assigned costs)

- New Jersey Division of Rate Counsel

- Old Dominion Electric Co-op (utility assigned cost)

- Organization of PJM States

- North Carolina Electric Membership Corp. (utility assigned cost)

- Pennsylvania Office of Consumer Advocatte

- Maryland Office of People's Counsel

- Maryland Public Service Commission

- PSEG (utility building lines)

- West Virginia Public Service Commission

- Southern Maryland Electric Co-op (utility assigned costs)

- Pennsylvania Public Utility Commission

- Dayton Power and Light (utility assigned costs)

- Ohio Consumer's Counsel

- American Municipal Power (utility assigned costs)

- Long Island Power Authority (utility assigned costs)

- Virginia State Corporation Commission

- Northern Va. Electric Co-op (utility assigned costs)

So, what happens next? There may be more intervenors and more comments, but eventually FERC will issue an order. No matter what FERC decides, one "camp" or the other isn't going to like it. That camp will file for rehearing. FERC will reconsider the matter and issue another order. One camp won't like that and will file an appeal in the federal circuit court(s) of appeal. The Court will decide the matter and remand it to FERC with instructions to issue a new order that comports with the Court's instructions. Once FERC issues the new order, it may be appealed again, and back to the courts it goes. One camp may decide to appeal the federal court's order to SCOTUS. It's going to drag on for years, like a bad soap opera.

Meanwhile, PJM will continue to pursue its projects. If any cost allocation adjustment are made due to the appeals, that's a money issue that will be taken care of through rates. The utilities assigned to build these projects will file applications for permits to construct with some of the intervening states. Think about how that will go... If a state denies a permit, permitting may be bumped up to FERC under new backstop permitting laws created by the Infrastructure Investment and Jobs Act in 2021. The longer the permitting process for these projects, the higher their costs climb.

And what about those costs? Will the possibility that zones in Virginia and Maryland are eventually assigned more of the costs become a risk factor that will impact the need for these projects in the first place? Will data centers want to continue to build in Virginia and accept the risk that the cost of their electricity is going to skyrocket in the future when the legal cases are finally settled? Or will they decamp to cheaper pastures without the risk? (Don't let the door hit you in the ass on the way out!). And what about Maryland? Will skyhigh electricity costs cause Maryland to re-think its clean energy policies that prohibit the building of new fossil fuel plants? Will Maryland begin a nuclear generation renaissance that could be equally expensive?

Those are the only changes that will make a difference in PJM's load forecast, but getting there will be rough. PJM never changes its mind, once it is made up. FERC should require PJM to create a new cost allocation method for new transmission due to state "clean energy" policies that is involuntarily allocated to the states whose policies cause the new transmission. PJM should also create a new cost allocation policy dealing specifically with data centers. This relatively new electric user stands out as a huge load that must be separated from normal, incremental load increases. Data centers use so much power, they are in a class by themselves. While FERC cannot allocate costs directly to data centers, it can allocate costs to the zones in states where the building is causing need for new transmission. It would then be up to the state whether to spread the costs of the transmission among all users, or allocate it to data centers directly. Whatever happens, it won't be an easy decision, and someone isn't going to like it.

Probably you. Your electric bill is going to skyrocket.

Be sure to tune in to our next episode when FERC issues an order on PJM's cost allocation filing... this is going to be the longest running soap opera in history!

RSS Feed

RSS Feed